Users vent out displeasure, want government to crack whip

WhatsApp Privacy Policy Survey Report

Survey and analysis by Deepak Kumar

There is a thin line that divides respect for privacy and intrusion of privacy. In the age of the digital, this line becomes wavy and fuzzy as well. For big internet companies, the user data that resides behind the line is a gold mine. The more they get of it, the richer they get.

The recent WhatsApp privacy policy changes are just about that. By gaining a right to use and share WhatsApp’s select user data with partners, Facebook aspires to gain an unsurmountable edge in the digital advertising world. It goes without saying that WhatsApp data can help reap rich ad dividends for parent company Facebook. Users are not pleased. In respose to the one-week-long Better World survey concluded recently, a majority of them (67%) want the government to step in some way, as discussed ahead in this report. Notably, these include Business WhatsApp users as well. In fact, by the time of writing this report, various leading media portals had reported that government had written to WhatsApp and asked the company to roll back the proposed privacy-policy changes.

It all started when WhatsApp started sending out notifications to its users to the effect that it had updated its privacy policy and the users could either accept the new policy or quit using WhatsApp by 8 February 2021. Meanwhile, while this report was underway, the deadline was extended by more than three months. Users now have to accept the new privacy policy by 15 May.

WhatsApp’s privacy-policy change and the aftermath

Users’ retort has indeed been quick, sharp, and massive. They poured out their disapprovals in words as well as in actions. Millions of users posted and tweeted their angst against the move and even signed up on alternative messaging apps such as Signal and Telegram. Tesla Founder Elon Musk’s two-word tweet, “Use Signal,” helped drive a switch from WhatsApp, particularly given his following of 41.5 million on Twitter.

The rush to leave WhatsApp was so high that servers of Signal were not able to take the load of new signups. At one point, Signal sent out a tweet, “Verification codes are currently delayed across several providers because so many new people are trying to join Signal right now…Hang in there.”

On 11 January 2021, Facebook’s shares declined 4.01% on a day when Nasdaq slipped just 1.55%. On 12 January, it further declined 2.24% on a day when Nasdaq rose 0.77%. On 14 January, it happened to be at the lowest in more than six months.

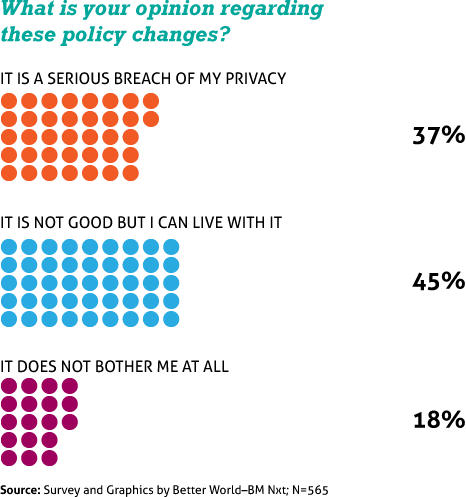

Better World ran a quick user survey, where 37% users said they considered the move a serious breach of their privacy, while 45% said they it was not good but they could live with it. Only around 18% said the change didn’t bother them at all. However, some of these 18% users were already using other messaging apps along with WhatsApp.

What’s the big deal about privacy in the age of social media?

In the age of social media, many of us have become comfortable sharing our thoughts and views on Facebook. In fact, many people don’t mind sharing sensitive personal information such as location and travel plans not just with friends but also with public at large.

However, when it comes to WhatsApp, the behavior often changes. Many of the users’ chats are peer-to-peer in nature and may not be meant for public viewing or consumption. The same would apply to the other activities they perform on WhatsApp, whether today or in future. These would include the financial and transactional activities performed on the WhatsApp platform.

In a digital living environment, if a Facebook wall may be considered comprising areas of the lobby and the living room, WhatsApp will certainly be akin to the bedroom and beyond.

No wonder, the recent changes in WhatsApp’s privacy policy have created a din that Facebook could not see coming.

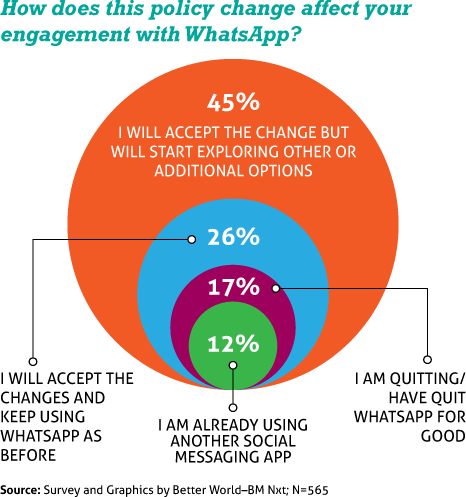

In the wake of the user backlash, WhatsApp had to get into a defensive mode, sending out clarifications and explanations. However, a damage had been done by then. In a first reaction, 17% users responded to the Better World survey said they were quitting/had quit WhatsApp for good, while 45% said they would accept the change but start exploring other or additional options. Interestingly, 12% said they were already using another social messaging app. However, a good 26% said they would accept the changes and keep using WhatsApp as before.

The myth that users are unaware and don’t care for privacy is broken

Often, as an extension to the assumption that transparency is the hallmark of a digital age, it is argued that privacy is hardly a thing that users care about. The user backlash against WhatsApp’s privacy assumptions easily breaks that myth. It also reminds one of the “Free Basics” event a few years ago. Users had then considered it an attempt to compromise ‘net neutrality,’ and Facebook had to roll the offer back.

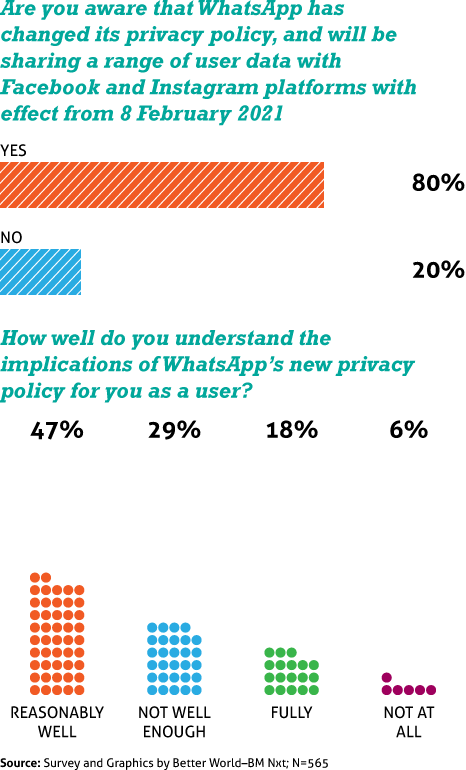

The promptness of users in defending their privacy and other rights can easily be evidenced by these two examples. The events also show that users are well aware of the repercussions of any policy change or a new offering in the internet world. This is echoed by this survey results, with 80% users stating they were aware that WhatsApp was changing its privacy policy, and would be sharing a range of user data with Facebook and Instagram platforms with effect from 8 February 2021 (now 15 May 2021). The remaining 20% users said they were not aware of such changes. It is likely that some of these users were yet to receive the notifications regarding policy change when they took this survey.

Further, around 47% of users said they understood the implications of WhatsApp’s new privacy policy for users reasonably well and another 18% said they understood it fully well. By contrast only 29% said they didn’t understand it well enough while another 6% said they didn’t understand it at all. Overall, this implies a high incidence of awareness around WhatsApp’s new privacy policy.

Notably, while the messages will remains end-to-end encrypted, the new policy means sharing a host of user-related information with Facebook and other third-party platforms. These include information about a user’s location, IP address, mobile operator, timezone, phone number, and receipt of a Facebook or WhatsApp account. Additionally, conversations associated with business accounts will now be shared with Facebook.

The damage-control measures may be too little too late; more is needed

WhatsApp has issued a number of clarifications and explanations pertaining to the change. Those clarifications, however, have been far from satisfactory. Its parent company Facebook says the new policy changes are directed only at Business WhatsApp accounts and not the individual accounts. Also, it says only certain ad-related information will be shared with Facebook and other group companies.

However, on the actual Privacy Policy page, some of the statements may sound alarming to users. It states in one place, “We work with third-party service providers and other Facebook Companies to help us operate, provide, improve, understand, customize, support, and market our Services,” and adds, “When we share information with third-party service providers and other Facebook Companies in this capacity, we require them to use your information on our behalf in accordance with our instructions and terms.”

What if third-party service providers don’t follow the “instructions and terms,” as had happened when in 2018 Cambridge Analytica was found to have harvested data of 87 million users from Facebook in 2016 under the guise of a survey app? In September 2018, again, hackers were able to exploit an API vulnerability to gain access to data of around 50 million users. In September 2019, data of 419 million Facebook users, including names and phone numbers, was exposed online, said Techcrunch. Three months later, data of 267 million Facebook users was reported by Comparitech as being in the wild. In March 2020, Comparitech revised the number to 309 million after finding data of another 42 million residing on another server had been compromised as well.

Given Facebook’s not-so-stellar record in protecting user data from being exploited by threat actors, it may be concerning for users to let some of their WhatsApp data be mined by Facebook and other third-party service providers.

WhatsApp, on its Privacy Policy page, further adds, “When you or others use third-party services or other Facebook Company Products that are integrated with our Services, those third-party services may receive information about what you or others share with them.” “Please note that when you use third-party services or other Facebook Company Products, their own terms and privacy policies will govern your use of those services and products.”

WhatsApp is not clear what this amounts to when used in conjunction with the previous two statements. Does this mean that if WhatsApp users share certain information with Facebook or other third-party services integrated with WhatsApp, the privacy policies of those services take over and WhatsApp’s privacy policy loses jurisdiction?

It will help if WhatsApp addresses such concerns and questions in its Privacy Policy document.

Pavan Duggal, Indian cyber law expert

Pavan Duggal, Indian cyber law expert

“I’m surprised that WhatsApp has done this even though India is their largest market. Effectively this means that WhatsApp, apart from sharing personal data, also discloses your transaction-associated information, which means including your credit card number, your debit card number, and your bank details. At the same time, they will share the IP address of users. It’s a very perilous situation, especially in a country that lacks a strong legal ecosystem around cyber laws and data security. Such policy changes can upsurge the probabilities of misusing users’ data by anti-social elements. I strongly believe that people should count on more secure platforms such as Signal and Telegram for their messaging needs now.”

Rajesh Agarwal, Head IT, Aamor Inox

Rajesh Agarwal, Head IT, Aamor Inox

“People are moving to Signal and Telegram, but they are also coming back to WhatsApp. I’ve been using Signal for some time, along with WhatsApp, and found it is not as mature as WhatsApp is. There are many missing aspects in Signal, like, the personal reply feature. I found even the deletion of chat a cumbersome process in Signal. I understand the privacy concerns, but that’s there across the app ecosystem, and here WhatsApp is at least telling users what it is sharing and what’s not. Most of the users are testing Telegram and Signal while keeping WhatsApp as a primary communication tool. It will be exciting to see if this behaviour fluctuates and WhatsApp could address some of the privacy concerns that users may have”

Shashwat DC, Communications & Engagement (Research) at Azim Premji University

Shashwat DC, Communications & Engagement (Research) at Azim Premji University

“While WhatsApp may try to dispel all fears about privacy expounding that its messaging platform is end-to-end encrypted, in reality, Facebook seems to trying to seize a lot of personal data to earn from its advertising business. To avoid such instances and provide users much-needed control over their data, India needs to implement its data protection law just like Europe’s stringent GDPR at the earliest. The world’s largest democracy, with a burgeoning IT sector, cannot risk the privacy of its citizens.”

There is a need for stakeholders to establish certain minimum privacy-policy norms

The right to privacy has been recognized as a fundamental right emerging primarily from Article 21 of the Constitution of India. Article 21 pertains to protection of life and personal liberty, and states, “No person shall be deprived of his life or personal liberty except according to procedure established by law.” In August 2017, Government of India had set up a committee under the chairmanship of retired Justice BN Srikrishna to submit a report on data protection. The committee submitted its report in July 2018.

In its opening note, the report recognized that “the protection of personal data holds the key to empowerment, progress, and innovation.”

The Committee had noted that “any regime that is serious about safeguarding personal data of the individual must aspire to the common public good of both a free and fair digital economy.” “Freedom refers to enhancing the autonomy of the individuals with regard to their personal data in deciding its processing which would lead to an ease of flow of personal data,” it added.

Justice Srikrishna Committee had emphasized that processing (collection, recording, analysis, disclosure, etc.) of personal data should be done only for “clear, specific and lawful” purposes. Also, only that data which is necessary for such processing is to be collected from anyone.

Based on the recommendations of the committee, amounting to a draft Personal Data Protection bill prepared in 2018, a revised Personal Data Protection Bill was approved and placed in December 2019. A joint Parliamentary Committee (JPC) chaired by Meenakashi Lekhi and comprising 20 members from Lok Sabha and 10 members from Rajya Sabha was constituted to submit its report. The JPC had conducted more than 55 sittings in 2020. Oral evidences were heard by the JPC from various state as well as non-state actors including Amazon, Google, Facebook, Jio Platforms, Paytm, and Twitter, among others. The final report of the JPC is awaited.

Despite the fact that right to privacy has been recognized as a fundamental constitutional right, experts have been of the opinion that a law on data protection should be dynamic and not statutory in nature. This is more so because as digital economy becomes more and more prevalent and mainstream, data itself becomes dynamic in nature.

Coming to data protection, it is important to first distinguish between stationary data and moving data. While it can be reasonably guaranteed to foolproof privacy and security of stationary data, it can get very hard to ensure privacy of moving data.

The velocity of a moving data can be lightning fast in today’s digital environments. So once a private data gets into a public domain, even the slightest lapse or gap at the end of a data custodian could be disastrous. The hacks and misuses listed out earlier in this report are a testimony to this assertion.

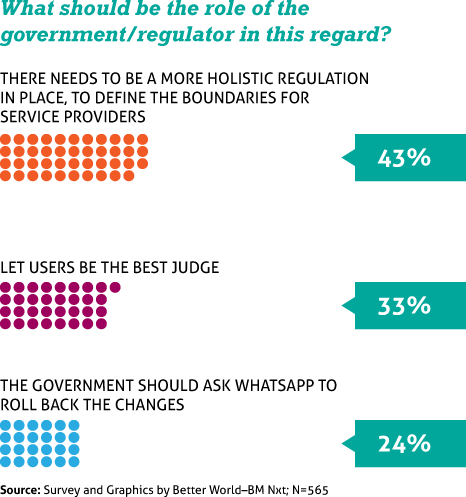

It is therefore critical that, as we progress further into the digital economy, we ought to remove all regulatory fuzziness and laxity on the privacy front. A majority of respondents to the Better World survey subscribe to this view, with 24% noting that the government should ask WhatsApp to roll back the changes and another 43% stating that there needs to be a more holistic regulation in place. However, 33% of the users said that it would be better to let users be the best judge, though less than 22% of these users said they were fully aware of the implications of WhatsApp’s new privacy policy as users. Of the remaining 78%, slightly more than 26% said as users they didn’t understand the implications of WhatsApp’s new privacy policy at all or well enough, though more than 54% of these users said they reasonably understood the implications if not fully well.

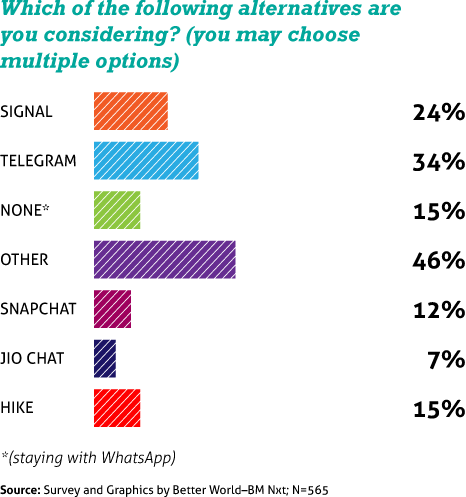

The choice of alternative reinforces that privacy is the key concern

Signal, which is considered to be the most privacy-oriented messaging app (see Table), was the first choice of those users who said they will look for WhatsApp alternatives. In this case, respondents had the option of selecting one or more apps, including WhatsApp. Telegram, which is considered second-most privacy-friendly app, had the second highest user preference.

While 34% of the users voted for Telegram as a WhatsApp alternative (and in some cases, as a replacement), a good 24% voted for Signal also. A fair percentage of respondents (15%) said they were sticking with WhatsApp even though they were using or considering to use apps other than WhatsApp as well.

The immediate user response, as evidenced from the survey, has been quite aggressive. While 18% of respondents said they had already quit WhatsApp as the only app, another 25% said they planned to do so within a week’s time and yet another 29% said they planned to quit in a month’s time. However, 28% said they had no plans to quit WhatsApp.

| Features | Telegram | Signal | |

|---|---|---|---|

| Subscribers (Global) | 2 billion | 400 million | 20 million |

| Cross platform | Yes | Yes | Yes |

| Video and voice call | Yes | Yes | Yes |

| End-to-end encryption | Personal messages and calls are end-to-end encrypted. | Only for secret chat | All features are end-to-end encrypted |

| Type of software | Closed-source privacy | Open-source privacy | Open-source privacy |

| Information collection | Users location, IP address, mobile operator, timezone, phone number, and details of a Facebook or WhatsApp account. | Device data, IP addresses for moderation, phone number and the User ID | Only phone number for registration |

| Group chats | Up to 256 members | Up to 200,000 members | 1,000 members |

| File sharing capability | Videos with 16MB limit in size and regular files up to 100MB | 2 GB | 100 MB |

| Folder management | Chats can be stored through email | Chats can be moved in to folders | No such feature exists with Signal |

| Disappearing messages feature | Enables self-destruction of a message after 7 days | Enabled through self-destruct timer | Enable self-destruction after 5 seconds to 7 days once a user read the message |

| Data backup | Yes, online and offline backup on google drive | Yes, on Telegrams cloud | No, stored on its own cloud platform |

| Group chat security | E2E | No | E2E |

| Cross platform | Yes | Yes | Yes |

Analyst’s Views

Better World is of the view that while the responses to this survey do reflect users’ displeasure with the new privacy policy, the actual actions taken by them will likely be different in many cases. Particularly, those users who are considering to quit WhatsApp in a month’s time, are more likely to have second thoughts and may stay put. It is also likely that some of the users who have already quit may come back after some time.

The key reason for such reconsiderations would be the huge user base that WhatsApp currently enjoys. While WhatsApp had a colossal global base of 2 billion subscribers, Telegram has a much smaller base of 400 million and Signal has a miniscule base of 20 million by comparison. Even if a few million WhatsApp users move to other platforms, it will not be fruitful if a significant percentage of their contacts also move to those very platforms. If that doesn’t happen, users could feel compelled to come back to WhatsApp for their daily messaging needs.

Notably, when considering alternative apps, 26% said they were sticking with WhatsApp. Further, when asked to provide a timeline for quitting, 28% said they had no plans to quit. It is quite possible that when it comes to actually quitting the platform, a much higher number of users will reconsider.

A consolidated view of respondents’ profiles

About the Analyst and the Survey Methodology

Deepak Kumar

Deepak Kumar

Deepak is an ICT industry analyst with more than 25 years of experience in researching and analyzing multiple domains. His focus areas are strategic business and marketing advisory, sales enablement, and public speaking. He has published reports, whitepapers, case studies, and blogs in areas of cloud, mobility, social media, and analytics.

He is Founder and Chief Research Officer at BM Nxt and Better World. He has earlier worked with IDC, Reuters, Voice&Data, and Dataquest in leadership roles spanning research, advisory, and editorial functions.

About the report

The Better World WhatsApp Privacy Policy Survey Report was prepared by analyzing results of a primary research and supplementing it with data and insights collected from secondary research.

The Better World WhatsApp Privacy Policy Survey was conducted via an online form that was circulated among more 1,000 respondents. A total of 565 valid responses were collected during the period 9 January to 25 January 2021. Better World also spoke to multiple respondents for qualitative insights. The surveys were led by Jatinder Singh, Director, Research and Insights, Better World, and independent market researcher Deepti Arora.

Acknowledgements

I take this opportunity to sincerely thank all the survey respondents for taking time out and providing their inputs, without which this report would not have been completed in a timely manner.

0 Comments