यूज़र्स चाहते हैं कि सरकार Whatsapp प्राइवेसी पॉलिसी में हस्तक्षेप करे।

Whatsapp प्राइवेसी पॉलिसी सर्वे रिपोर्ट

विश्लेषण: दीपक कुमार

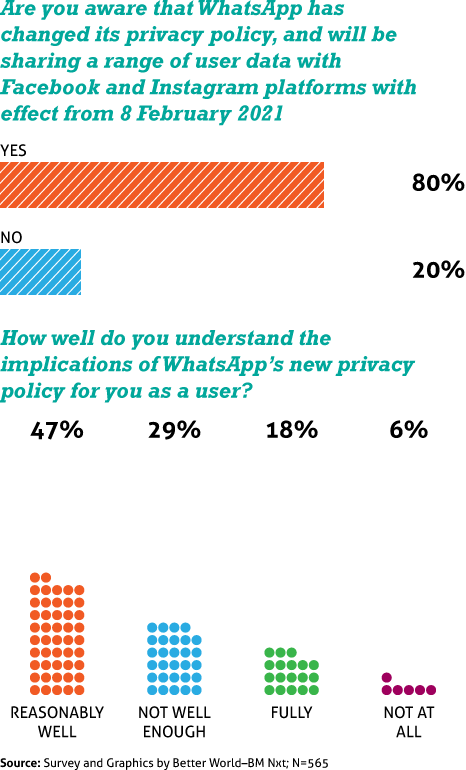

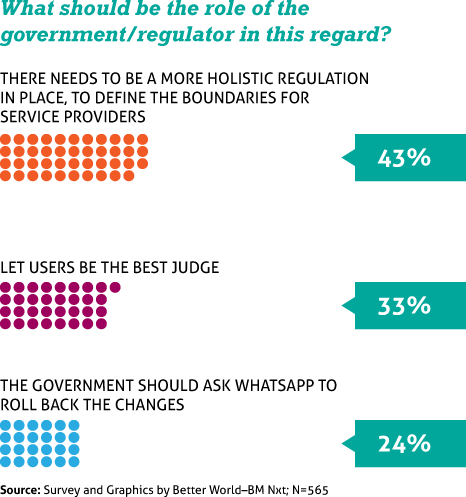

हाल ही में Whatsapp प्राइवेसी पॉलिसी में बदलाव प्रस्तावित किये गए हैं, जिसपर चर्चा काफी गर्म है । इंटरनेट कंपनियों द्वारा यूजर डेटा की गोपनीयता का सम्मान करने और न करने के बीच एक पतली रेखा है। आज के डिजिटल युग में यह रेखा और भी पतली हो गई है। बड़ी इंटरनेट कंपनियों के लिए, यूजर डेटा एक सोने की खान जैसा है।

व्हाट्सएप यूजर डेटा को फेसबुक तथा अन्य बिज़नेस पार्टनर्स के साथ साझा करने का अधिकार प्राप्त करना चाहता है। इससे पेरेंट कंपनी फेसबुक डिजिटल विज्ञापन की दुनिया में एक सशक्त बढ़त हासिल कर सकती है। यह सर्वविदित है कि व्हाट्सएप डेटा फेसबुक के विज्ञापन बिज़नेस को काफी लाभ पहुंचा सकता है।

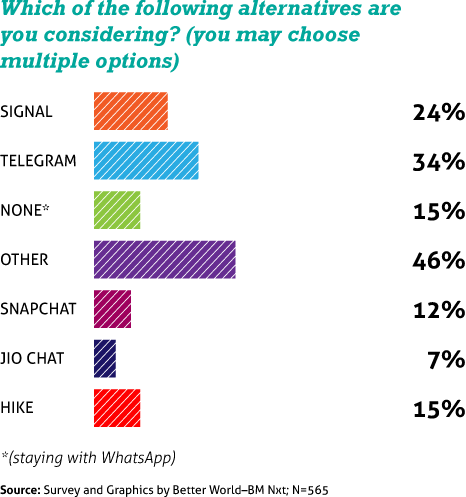

उपयोगकर्ताओं का बड़े पैमाने पर विरोध साफ़ दीखता है। लाखों उपयोगकर्ताओं ने इस कदम के खिलाफ अपने विरोध को पोस्ट और ट्वीट किया और यहां तक कि सिग्नल और टेलीग्राम जैसे वैकल्पिक मैसेजिंग ऐप्स को ज्वाइन भी किया। टेस्ला कंपनी के संस्थापक एलोन मस्क के ट्वीट, “सिग्नल का उपयोग करें”, ने व्हाट्सएप छोड़ने की एक मुहिम सी चलाने में मदद की। ट्विटर पर उनके 41.5 मिलियन फॉलोवर्स होने का भी इस मामले में काफी प्रभाव पड़ा।

शुरु में तो व्हाट्सएप छोड़ने की होड़ इतनी ज्यादा थी कि सिग्नल के सर्वर नए साइनअप का भार उठाने में सक्षम नहीं थे। एक समय सिग्नल ने ट्वीट करके सफाई तक दी कि एक साथ कई नए लोगों के साइन करने के कारण सर्वर आवश्कतानुसार काम नहीं कर पा रहे हैं, अतः लोग थोड़ा धैर्य रखें।

11 जनवरी 2021 को, फेसबुक के शेयरों में 4.01% की गिरावट आई जबकि Nasdaq index सिर्फ 1.55% गिरा । 12 जनवरी को फेसबुक 2.24% गिरा जबकि Nasdaq 0.77% बढ़ा। 14 जनवरी को, यह छह महीने से अधिक समय में सबसे कम पर हुआ।

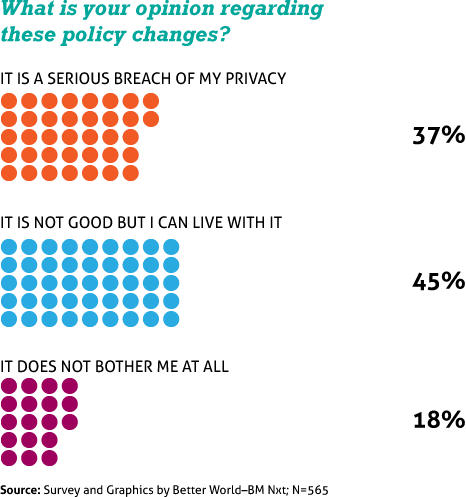

Better World द्वारा किए गए सर्वे में जहां 37% उपयोगकर्ताओं ने कहा कि वे whatsapp के इस कदम को अपनी गोपनीयता का गंभीर उल्लंघन मानते हैं, 45% ने कहा कि यह अच्छा नहीं पर वे इसे मान लेंगे । केवल 18% ने कहा कि whatsapp की प्रस्तावित गोपनीयता नीति में परिवर्तन से उन्हें बिल्कुल परेशानी नहीं है। हालांकि, इन 18% उपयोगकर्ताओं में से कुछ पहले से ही व्हाट्सएप के साथ अन्य मैसेजिंग ऐप का उपयोग कर रहे थे।

| Features | Telegram | Signal | |

|---|---|---|---|

| Subscribers (Global) | 2 billion | 400 million | 20 million |

| Cross platform | Yes | Yes | Yes |

| Video and voice call | Yes | Yes | Yes |

| End-to-end encryption | Personal messages and calls are end-to-end encrypted. | Only for secret chat | All features are end-to-end encrypted |

| Type of software | Closed-source privacy | Open-source privacy | Open-source privacy |

| Information collection | Users location, IP address, mobile operator, timezone, phone number, and details of a Facebook or WhatsApp account. | Device data, IP addresses for moderation, phone number and the User ID | Only phone number for registration |

| Group chats | Up to 256 members | Up to 200,000 members | 1,000 members |

| File sharing capability | Videos with 16MB limit in size and regular files up to 100MB | 2 GB | 100 MB |

| Folder management | Chats can be stored through email | Chats can be moved in to folders | No such feature exists with Signal |

| Disappearing messages feature | Enables self-destruction of a message after 7 days | Enabled through self-destruct timer | Enable self-destruction after 5 seconds to 7 days once a user read the message |

| Data backup | Yes, online and offline backup on google drive | Yes, on Telegrams cloud | No, stored on its own cloud platform |

| Group chat security | E2E | No | E2E |

| Cross platform | Yes | Yes | Yes |

Analyst’s Views

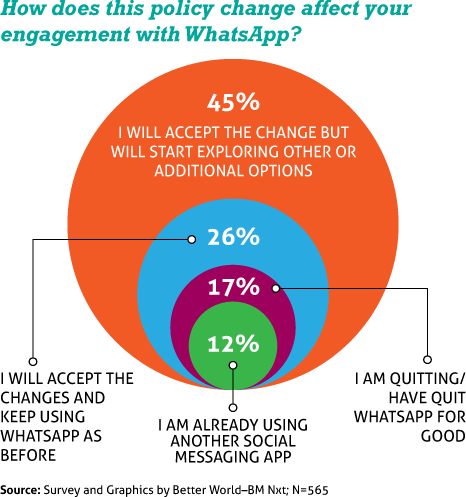

Better World is of the view that while the responses to this survey do reflect users’ displeasure with the new privacy policy, the actual actions taken by them will likely be different in many cases. Particularly, those users who are considering to quit WhatsApp in a month’s time, are more likely to have second thoughts and may stay put. It is also likely that some of the users who have already quit may come back after some time.

The key reason for such reconsiderations would be the huge user base that WhatsApp currently enjoys. While WhatsApp had a colossal global base of 2 billion subscribers, Telegram has a much smaller base of 400 million and Signal has a miniscule base of 20 million by comparison. Even if a few million WhatsApp users move to other platforms, it will not be fruitful if a significant percentage of their contacts also move to those very platforms. If that doesn’t happen, users could feel compelled to come back to WhatsApp for their daily messaging needs.

Notably, when considering alternative apps, 26% said they were sticking with WhatsApp. Further, when asked to provide a timeline for quitting, 28% said they had no plans to quit. It is quite possible that when it comes to actually quitting the platform, a much higher number of users will reconsider.

A consolidated view of respondents’ profiles

About the Analyst and the Survey Methodology

Deepak Kumar

Deepak Kumar

Deepak is an ICT industry analyst with more than 25 years of experience in researching and analyzing multiple domains. His focus areas are strategic business and marketing advisory, sales enablement, and public speaking. He has published reports, whitepapers, case studies, and blogs in areas of cloud, mobility, social media, and analytics.

He is Founder and Chief Research Officer at BM Nxt and Better World. He has earlier worked with IDC, Reuters, Voice&Data, and Dataquest in leadership roles spanning research, advisory, and editorial functions.

About the report

The Better World WhatsApp Privacy Policy Survey Report was prepared by analyzing results of a primary research and supplementing it with data and insights collected from secondary research.

The Better World WhatsApp Privacy Policy Survey was conducted via an online form that was circulated among more 1,000 respondents. A total of 565 valid responses were collected during the period 9 January to 25 January 2021. Better World also spoke to multiple respondents for qualitative insights. The surveys were led Jatinder Singh, Director, Research and Insights, Better World, and independent market researcher Deepti Arora.

Acknowledgements

I take this opportunity to sincerely thank all the survey respondents for taking time out and providing their inputs, without which this report would not have been completed in a timely manner. Special thanks are due to the following individuals for adding value to the report and providing viewpoints representative of different user and stakeholder segments.

0 Comments